Bloomingdale’s Customer Profile 2025: A Case Study in Audience Insights

Why Bloomingdale’s Audience Strategy Still Defines Luxury Retail

Bloomingdale’s has long stood as an icon of American luxury retail, a department store synonymous with heritage, quality and cultural cachet. Their instantly recognizable brown shopping bags have become symbols of status and style, reflecting a brand that balances exclusivity with accessibility. Guided by the ethos “to create a shopping experience that customers will not find elsewhere,” Bloomingdale’s continues to evolve in an increasingly competitive and omnichannel retail landscape.

While comparable to other luxury retailers such as Neiman Marcus and Saks Fifth Avenue, Bloomingdale’s has achieved stronger recent performance by embracing innovation across both physical and digital channels. The retailer’s pop-up concept “The Carousel” and its new smaller-format store, “Bloomie’s,” showcase how the brand leverages audience intelligence and retail personalization to stay relevant in a fast-changing industry.

According to Kevin Harter, VP of Integrated Marketing at Bloomingdale’s, the pop-ups have been “a great place for us to test out new brands and see how they resonate with our shopper.” This strategy illustrates how Bloomingdale’s is redefining luxury retail consumer behavior, using data-led experimentation to balance tradition with transformation.

TL;DR

Bloomingdale’s success offers a masterclass in how luxury retail adapts to modern consumers. Its shoppers blend tradition with self-expression, loyalty with experimentation, and in-store experience with digital discovery. From data-driven pop-ups to the smaller, omnichannel Bloomie’s format, the brand shows how insight, innovation and authenticity sustain relevance. This analysis, powered by TelmarHelixa’s Discover, reveals what marketers across retail can learn about evolving customer expectations, generational behavior and experience-led growth.

Who Shops at Bloomingdale’s: Understanding Its Audience

When evaluating the retail company, Bloomingdale’s, the first question most people ask is “so who shops at Bloomingdale’s?” Understanding this audience provides valuable insight into broader luxury retail consumer behavior trends and helps marketers see how audience intelligence can drive segmentation and brand strategy.

Using TelmarHelixa’s Discover Audience Insights Platform, Bloomingdale’s customers can be profiled across demographic, psychographic and lifestyle dimensions, weighted to represent the U.S. population accurately.

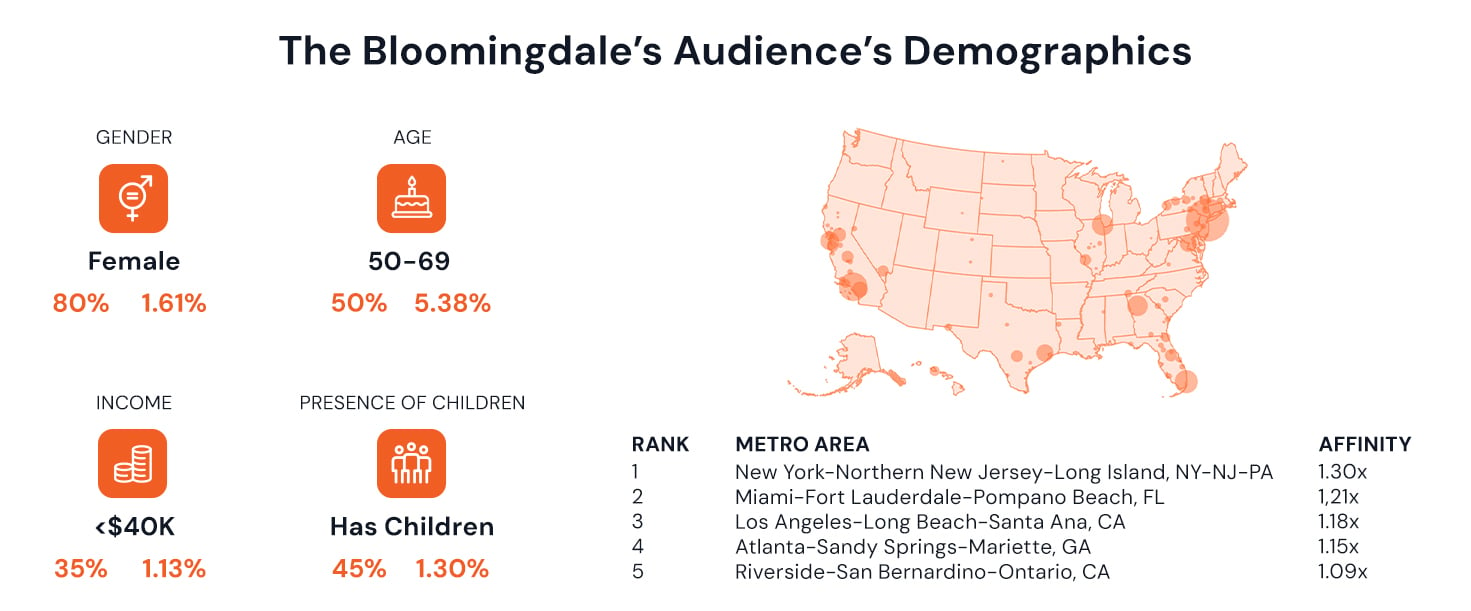

The Core Bloomingdale’s Demographics

- Female – 81% || 1.62×

- Aged 50–69 years old – 50% || 5.38×

- Has children – 48% || 1.41×

- Makes less than $40K a year – 33% || 1.13×

Top Metro Areas

- New York–Northern New Jersey–Long Island, NY–NJ–PA – 2.12×

- Los Angeles–Long Beach–Santa Ana, CA – 1.19x

- Chicago–Naperville–Joliet, IL–IN–WI – 1.28x

- Miami–Fort Lauderdale–Pompano Beach, FL – 1.41×

- Atlanta–Sandy Springs–Marietta, GA – 1.26×

Affinity (x) measures what is distinctive about a target audience; Reach (%) shows the share of the total audience engaged with the topic.

Bloomingdale’s attracts a mature, predominantly female customer base, many of whom are household decision-makers balancing family, lifestyle and fashion aspirations. These consumers represent a critical segment in the evolving luxury department store marketing strategy: they have disposable income, brand loyalty and a preference for tactile shopping experiences where service and atmosphere matter as much as product selection.

However, the data also signals a generational opportunity. As the store modernizes its experience, it is reinterpreting luxury for younger audiences who value accessibility, self-expression and brand purpose alongside heritage.

Bloomingdale’s Shoppers’ Top Buying Styles and Motivations

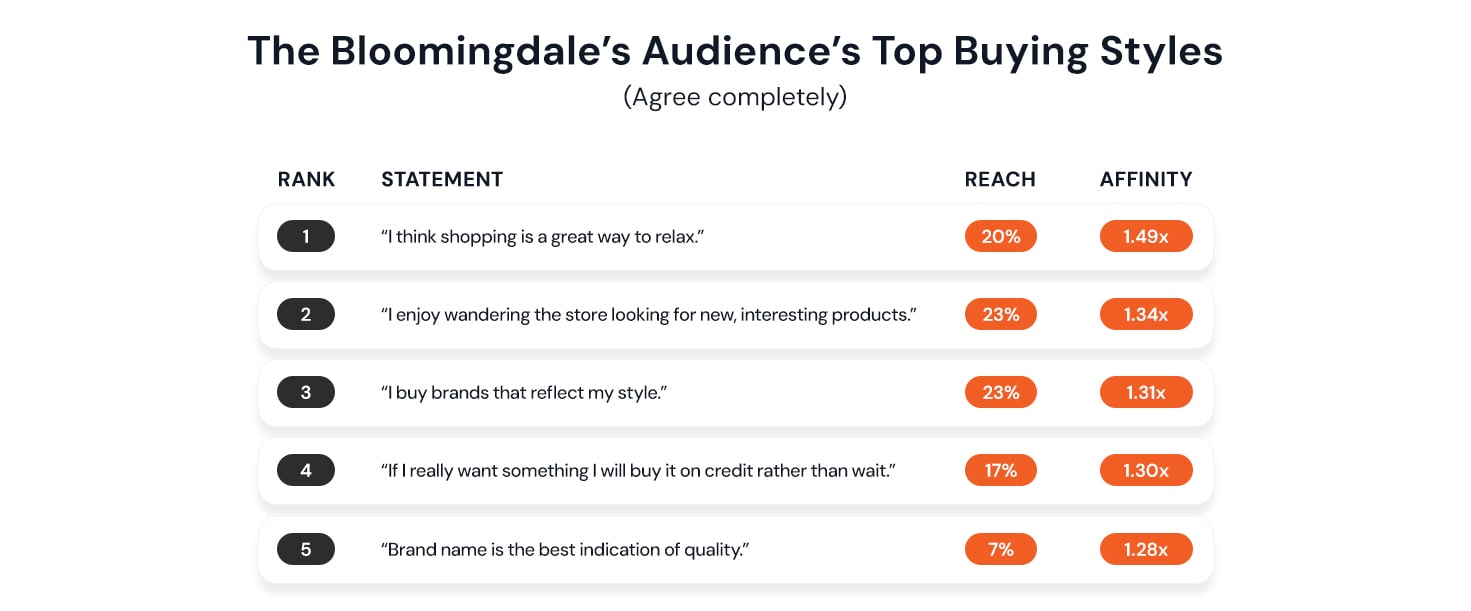

To uncover what drives Bloomingdale’s customers, TelmarHelixa’s Total Consumer View (in partnership with MRI-Simmons) reveals how this audience shops, and why they love the experience:

- “I think shopping is a great way to relax.” – 21% || 1.61×

- “I enjoy wandering the store looking for new, interesting products.” – 29% || 1.55×

- “I buy brands that reflect my style.” – 26% || 1.51×

- “I tend to make impulse purchases” – 12% || 1.38×

- “Brand name is the best indication of quality.” – 7% || 1.32×

These insights paint a picture of a consumer who views shopping not as a task but as an emotional and sensory experience. For many Bloomingdale’s shoppers, retail therapy remains an act of self-care, a way to unwind, explore and express personal identity.

This blend of leisure and luxury has always defined the department store model. Yet today’s audience expects that same emotional connection to extend across omnichannel retail experiences, whether browsing online, attending a pop-up or engaging with influencers on social media.

Key takeaway: The Bloomingdale’s customer shops with feeling, not function. Personalization, discovery and storytelling are central to sustaining that connection.

Bloomingdale’s Audience Favorites: Top Influencers and Luxury Brands

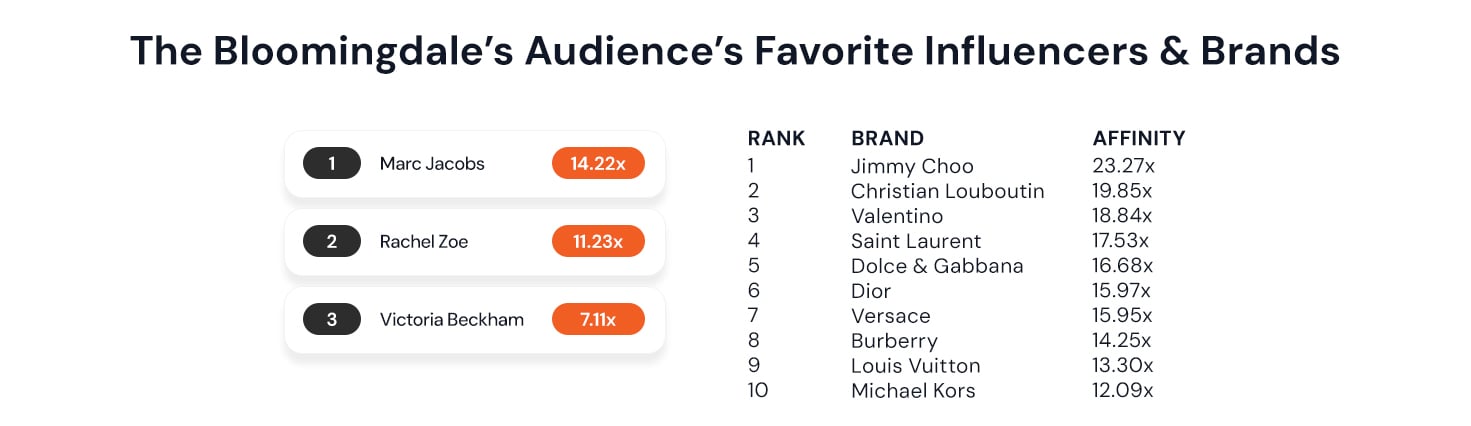

Influencers

- Marc Jacobs – 15.27×

- Rachel Zoe – 12.20×

- Victoria Beckham – 7.35×

Brands

- Jimmy Choo – 25.78×

- Christian Louboutin – 21.90×

- Valentino – 20.11×

- Saint Laurent – 19.03×

- Dolce & Gabbana – 17.48×

- Versace – 16.48×

- Dior – 16.19×

- Burberry – 15.12×

- Michael Kors – 13.26×

- Louis Vuitton – 13.16×

Bloomingdale’s audience clearly skews toward luxury fashion and aspirational aesthetics. Their admiration for designer icons like Marc Jacobs and Rachel Zoe reveals an alignment with craftsmanship, heritage and storytelling.

What’s notable is how these preferences reflect a cross-generational shift in influence. While older consumers associate these designers with timeless quality, younger audiences discover them through collaborations, digital activations and curated pop-ups. For Bloomingdale’s, these insights highlight the importance of maintaining brand partnerships that appeal across age and lifestyle boundaries.

Key takeaway: In luxury retail, influence is no longer defined by celebrity status but by cultural credibility. Bloomingdale’s capitalizes on this by pairing iconic designers with experiential formats that keep legacy brands relevant.

Bloomie’s: Bloomingdale’s New Store Concept Reinventing Retail

As more consumers shop online, physical retail must redefine its purpose. Bloomingdale’s has taken this challenge head-on by introducing Bloomie’s, a smaller-format concept designed for flexibility, convenience and engagement.

Described as having “everything you know and love about Bloomingdale’s”, just reimagined, Bloomie’s offers:

- Interactive events and community activations

- Virtual and in-person styling sessions

- Online pickup and returns

- On-site alterations

- Rotating, themed collections

Bloomie’s represents Bloomingdale’s answer to the omnichannel retail experience: a hybrid space where digital meets tactile, and discovery feels constant. Each store is designed to feel refreshed weekly, encouraging repeat visits and social sharing.

According to Rakuten, 66% of consumers increased their online spending during the pandemic, yet many still crave the immediacy of in-person shopping. Research by London retail and leisure destination, Battersea Power Station, reveals that 45% of shoppers prefer to shop in-store rather than online (30%). Gen Z and Millennials are 1.10× more likely to “often shop for fashion products online,” but they also appreciate stores that simplify returns, provide personal service and curate newness; exactly what Bloomie’s delivers.

Key takeaway: Bloomie’s isn’t a smaller store; it’s a smarter store. It bridges the gap between digital convenience and sensory experience, redefining how luxury retail engages modern consumers.

Gen Z and Millennial Luxury Shoppers: Bloomingdale’s Digital-First Fans

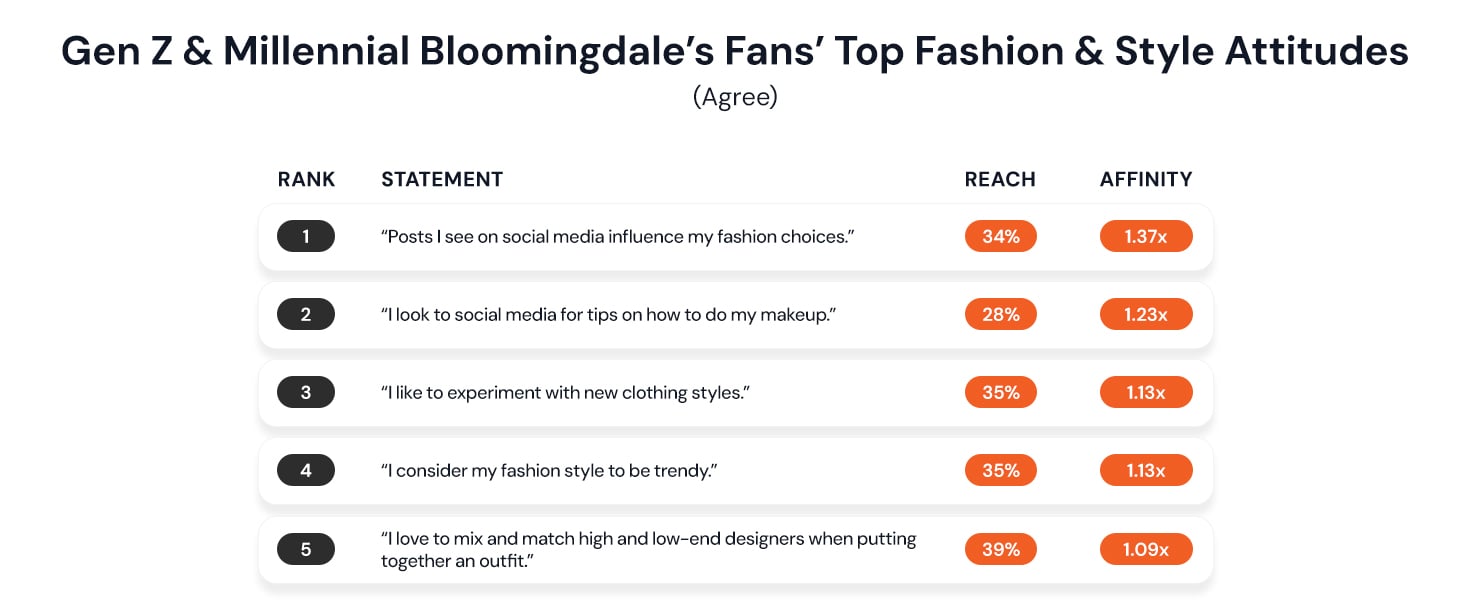

By studying Gen Z and Millennial Bloomingdale’s fans, TelmarHelixa identified the top fashion and style attitudes shaping this younger audience segment:

- “Posts I see on social media influence my fashion choices.” – 48% || 1.83×

- “I look to social media for tips on how to do my makeup.” – 51% || 1.97×

- “I like to experiment with new clothing styles.” – 51% || 1.50×

- “I consider my fashion style to be trendy.” – 46% || 1.55×

- “I love to mix and match high- and low-end designers when putting together an outfit.” – 57% || 1.64×

These connected generations use social media as both inspiration and validation. They discover trends through influencers, experiment with self-expression and view fashion as a fluid identity statement. For marketers, this highlights how Gen Z luxury shoppers expect brands to merge experience, storytelling and convenience seamlessly.

A Klarna study reinforces this, noting that younger consumers “appreciate the speed and efficiency of physical stores more than older shoppers, specifically, the ability to purchase and return items quickly.” Bloomingdale’s has recognized this behavioral nuance, creating Bloomie’s as a space where shoppers can engage on their own terms, online, offline or in-between.

Key takeaway: Younger audiences aren’t rejecting traditional retail; they’re redefining it. Brands that blend digital discovery with physical connection will win long-term loyalty.

Using Audience Intelligence to Truly Know Your Customers

Audience intelligence allows marketers to move from surface-level insights to emotional understanding. For Bloomingdale’s, this means seeing beyond purchase data to grasp why people shop.

The analysis shows that Bloomingdale’s customers don’t just buy clothes; they buy moments of joy and self-expression. The brand understands this emotional currency and designs its stores to make shoppers feel at home. From personalized experiences to on-site eateries and services, every detail reinforces its customer-first philosophy.

Bloomingdale’s is also adapting to digital-native expectations without losing its heritage. The retailer continues to invest in personalization, curated collections and data-led decision-making, aligning closely with TelmarHelixa’s belief that insight drives authenticity.

TelmarHelixa stands apart because it doesn’t simply listen to social noise; it transforms signals into meaning. Through its audience intelligence platform, brands can go beyond first-party data and static demographics to uncover psychographic motivations, emotional drivers and hidden growth pathways.

In just a few clicks, marketers can understand not only who their audience is, but what they believe, care about and aspire to; insights that translate directly into strategy, media planning and creative direction.

Key Takeaways for Marketers

- Luxury is evolving: Bloomingdale’s proves that heritage brands can stay relevant by pairing timeless values with modern experiences.

- Audience intelligence drives action: Understanding why people shop enables precise, empathetic marketing.

- Experience equals loyalty: The Bloomie’s model shows how convenience and connection can coexist.

- Younger shoppers want purpose: Gen Z and Millennials align with brands that reflect ethics, diversity, and community.

- Data fuels authenticity: Real-time insights turn brand stories into measurable results.

FAQs: Understanding Bloomingdale’s Audience and Retail Strategy

- What makes Bloomingdale’s audience unique in the luxury market?

Bloomingdale’s combines heritage shoppers aged 50–69 with younger, style-driven audiences, creating one of the most demographically diverse customer bases in luxury retail. - How is Bloomie’s changing the department-store model?

Bloomie’s reimagines the store as an omnichannel hub, smaller in footprint but richer in experience, offering local events, fast returns, and curated collections. - Why does Bloomingdale’s invest in audience intelligence?

Data helps Bloomingdale’s understand motivations, not just transactions. Insights from TelmarHelixa inform merchandising, partnerships, and marketing decisions. - What role do influencers play for Bloomingdale’s shoppers?

Influencers like Marc Jacobs and Rachel Zoe bridge legacy and modernity. They connect emotional storytelling to luxury craftsmanship, inspiring cross-generational loyalty. - How does Gen Z view luxury shopping?

Gen Z treats fashion as identity. They value sustainability, inclusivity, and experiences that blend digital discovery with physical touchpoints. - What can marketers learn from Bloomingdale’s success?

That authenticity, data, and agility are the cornerstones of modern brand growth, no matter the category.

Conclusion: What Bloomingdale’s Audience Insights Teach Luxury Retail Marketers

Bloomingdale’s demonstrates that luxury retail consumer behaviour is evolving, from exclusivity toward accessibility, from static categories toward dynamic experiences. The brand’s success lies in its ability to remain timeless while embracing change: using data to listen, creativity to connect, and personalisation to differentiate.

For marketers and retail strategists, the lesson is clear: insight leads to relevance, and relevance drives growth. By combining audience intelligence with authentic storytelling, Bloomingdale’s has turned its legacy into a living, learning brand.

Generate Actionable Insights at the Speed of Life. Ask us how